Bank Of Baroda Recruitment 2021 : Apply Online For 511 Manager Posts.

|

| Bank Of Baroda Recruitment 2021 |

Bank Of Baroda Recruitment 2021 : Bank of Baroda has published notification for the various post. Interested candidates may be apply. This post sr.Relationship Manager, e - wealth Relationship Manager, territory head, group head, product head, digital sales manager. Here post details, important dates, fees, vacancy, age limit, how to apply are given below. More details official website www.bankofbaroda.in

Post Name :

1. Sr. Relationship Manager

2. e - Wealth Relationship Manager

3. Territory Head

4. Group Head

5. Product Head (investment & Research)

6. Head (Operation & Technology)

7. Digital Sales Manager

8. IT Functional Analyst Manager

Total Vacancy : 511

Age limit as on 01.04.2021 :

1. Sr. Relationship Manager : 24 Years To 35 Years

2. e - Wealth Relationship Manager : 23 Years To 35 Years

3. Territory Head : 27 Years To 40 Years

4. Group Head : 31 Years To 45 Years

5. Product Head (investment & Research) : 28 Years To 45 Years

6. Head (Operation & Technology) : 31 Years To 45 Years

7. Digital Sales Manager : 26 Years To 40 Years

8. IT Functional Analyst Manager : 26 Years To 35 Years

Education Qualifications :

1. Sr. Relationship Manager :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Desirable qualification/certification :

- 2 years full time Post Graduate Degree / Diploma in Management

- Regulatory certifications e.g. NISM/IRDA

2. e - Wealth Relationship Manager :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Desirable qualification/certification :

- 2 years full time Post Graduate Degree / Diploma in Management

- Regulatory certifications e.g. NISM/IRDA

3. Territory Head :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Desirable qualification/certification :

- 2 years full time Post Graduate Degree / Diploma in Management

- Regulatory certifications e.g. NISM/IRDA

4. Group Head :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Desirable qualification/certification :

- 2 years full time Post Graduate Degree / Diploma in Management

- Regulatory certifications e.g. NISM/IRDA

5. Product Head (investment & Research) :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Desirable qualification/certification :

- 2 years full time Post Graduate Degree / Diploma in Management

6. Head (Operation & Technology) :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

7. Digital Sales Manager :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

8. IT Functional Analyst Manager :

A Degree (Graduation) in any discipline from a University recognised by the Govt. Of India./Govt. bodies/AICTE

Preference shall be given for candidates who possess degree in Engineering/Science/Technology.

Work Experience :

1. Sr. Relationship Manager :

Minimum 3 Years of Experience as Relationship Manager in Wealth Management with Public Banks / Private Banks / Foreign Banks / Broking Firms / Security Firms / Asset Management Companies.

Proficiency/knowledge in local language/area/market/clients is desirable.

2. e - Wealth Relationship Manager :

Minimum 2 Years of Experience as Relationship Manager in Wealth Management with Public Banks / Private Banks / Foreign Banks / Broking Firms / Security Firms / Asset Management Companies.

OR

2 years’ experience in sales/ services of High Value financial products through digital medium (telephone/video or web).

3. Territory Head :

Minimum 6 years of experience in Relationship Management in Wealth Management out of which minimum 2 years as a Team Lead.

Proficiency/knowledge in local language/area/market/clients is desirable

4. Group Head :

Minimum 10 Years of experience in managing sales in Wealth Management/Retail Banking/ Investments in the financial service industry.

- Should have managed a large team of Relationship Managers & Team Leads at Regional Level at least for 5 years.

5. Product Head (investment & Research) :

Minimum 7 years of experience as Investments product/advisory /strategy Manager.

6. Head (Operation & Technology) :

- Minimum 10 Years of experience in financial services, investment and private banking out of which minimum 8 years of experience in setting up and Managing Mid Office, Back Office and Branch Operations of Wealth Management set up.

- Exposure to Digital Sales will be preferred.

7. Digital Sales Manager :

Minimum 5 years of experience in driving sales of investment products through digital channel.

8. IT Functional Analyst Manager :

Minimum 5 years of experience in building and managing a technology platform and infrastructure in a wealth management set up.

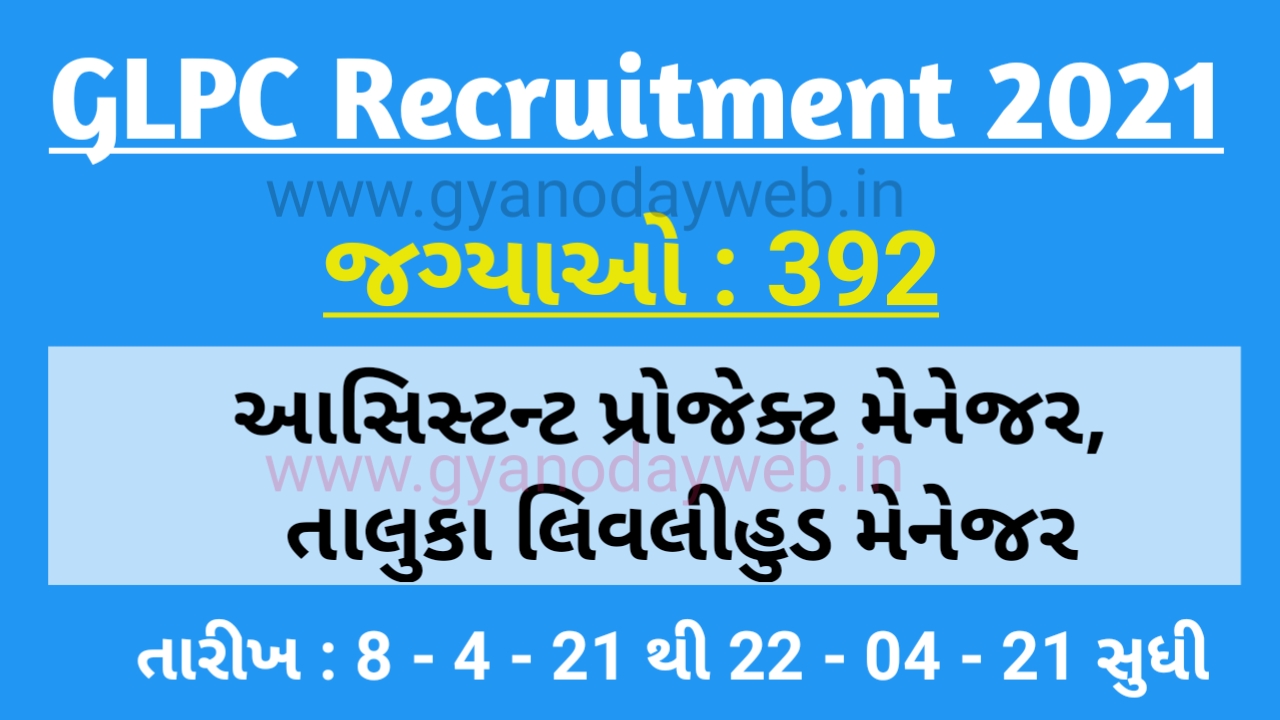

GLPC Recruitment 2021

Important Dates :

- Online Application Start : 09 - 04 - 21

- Last Date Online Application : 29 - 04 - 21

Application Fees :

- General & OBC Candidates : ₹ 600

- (plus applicable GST & transaction charges)

- SC/ ST/PWD/Women candidates : ₹ 100

- (plus applicable GST & transaction charges)

Important Links :

Download Notification : Click Here

Online Application : Click Here

How To Apply :

i. Candidates should visit Bank’s website www.bankofbaroda.co.in/Careers.htm and register themselves online in the appropriate Online Application Format, available through the link being enabled on the Career Page -> Current Opportunities on the Bank’s website & pay the application fee using Debit Card / Credit Card / Internet Banking etc.

ii. Candidates need to upload their Bio-data while filling online application. Candidates are also required to upload their scanned photograph, signature and other documents related their eligibility. Please refer to Annexure II regarding scanning of photograph & signature.

iii. Candidates are advised to carefully fill in the online application themselves as no change in any of the data filled in the online application will be possible/ entertained. Prior to submission of the online application, candidates are advised to verify the details in the online application form and modify the same if required. No change is permitted after clicking on SUBMIT button. Visually Impaired candidates will be responsible for getting the details filled in/carefully verifying, in the online application and ensuring that the same are correct prior to submission as no change is possible after submission.

iv. The name of the candidate should be spelt correctly in the application as it appears in the certificates/ mark sheets. Any change/ alteration found may disqualify the candidature.

v. An online application which is incomplete in any respect and unsuccessful fee payment will not be considered as valid.

vi. Candidates shall also be required to submit supporting documents such as DOB Proof, Graduation Certificate, Other Certifications, Category/PWD Certificate, Experience Letter, Document showing Break up of CTC, Latest Salary Slip (e.g.

February/March 2021), etc. at the time of submitting the online application form

vii. Candidates are advised in their own interest to apply online much before the closing date and not to wait till the last date to avoid the possibility of disconnection / inability / failure to log on to the website on account of heavy load on internet or website jam.

viii. Bank of Baroda does not assume any responsibility for the candidates not being able to submit their applications within the last date on account of aforesaid reasons or for any other reason beyond the control of Bank of Baroda.

ix. Candidates applying for the post of Territory Head and Sr. Relationship Manager have to choose the city/location from the list available at the time of submission of the application form.

Note : Instances for providing incorrect information and/or process violation by a candidate detected at any stage of the selection, process will lead to disqualification of the candidate from the selection process and he/she will not be allowed to appear in any of the recruitment process in the future. If such instances go undetected during the current selection process but are detected subsequently, such disqualification will take place with retrospective affect. Clarifications/Decisions of the Bank in respect of all matters pertaining to this recruitment would be final and binding on all candidates.